free forex signals

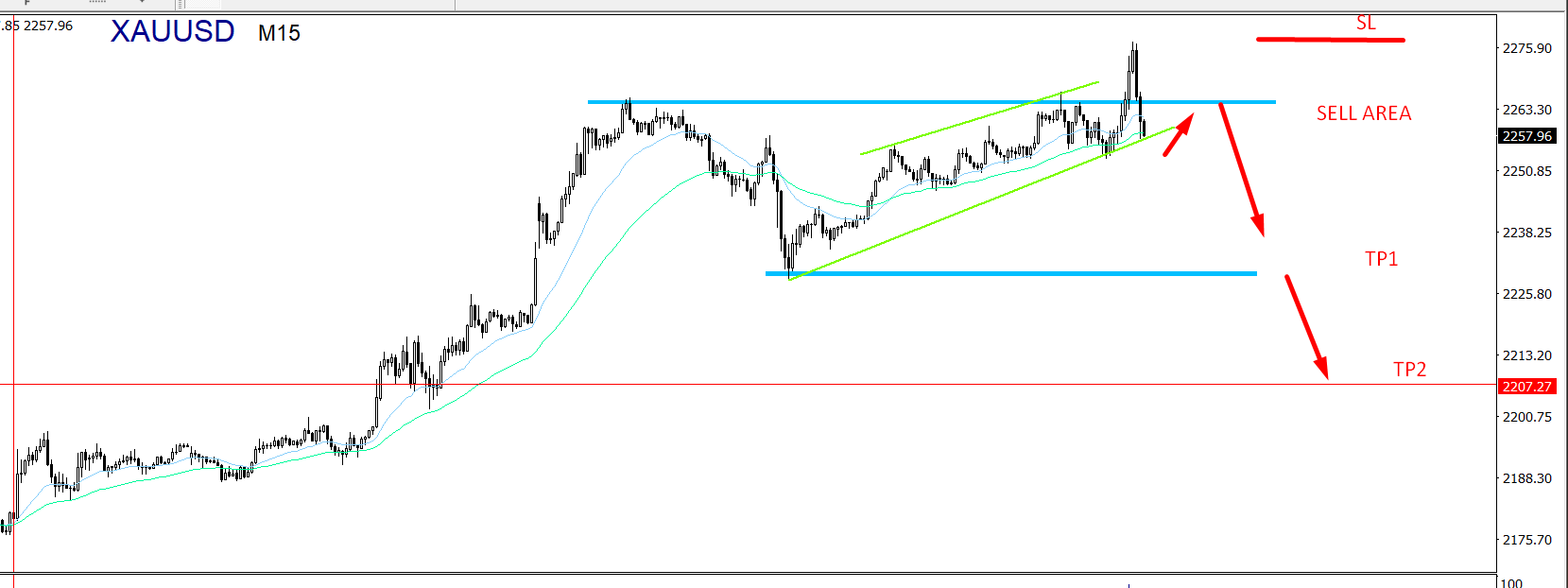

Trade Call: Gold Short Position

Instrument: Gold

Trade Type: Sell (Bearish)

Entry Details:

- Sell at Current Market Price (CMP): 2257

- Additional Sell Entry: Consider adding at 2265

Take Profit Targets:

- ✅ TP1: 2235

- ☑ TP2: 2220

- ✅ TP3: 2210

Stop Loss:

- ❎ SL: 2280

Risk Management:

- Using a half-percent risk management strategy

Rationale: Gold is showing signs of a bearish trend, prompting a sell position. Selling at the current market price of 2257 with the option to add more at 2265. Take-profit targets are set at 2235, 2220, and 2210 to capture potential downward movement. To mitigate risks, the stop loss is placed at 2280.

Market Conditions: The price of Gold is anticipated to decrease, influenced by factors such as economic indicators or shifts in market sentiment.

Adaptability: Continuous monitoring of economic indicators and market developments affecting Gold prices is crucial. Adapt the trading strategy based on real-time price action to optimize profit potential and manage risks effectively.

Trading involves risks, and traders should conduct their analysis and consider seeking advice from financial professionals before making trading decisions.