FREE FOREX SIGNALS

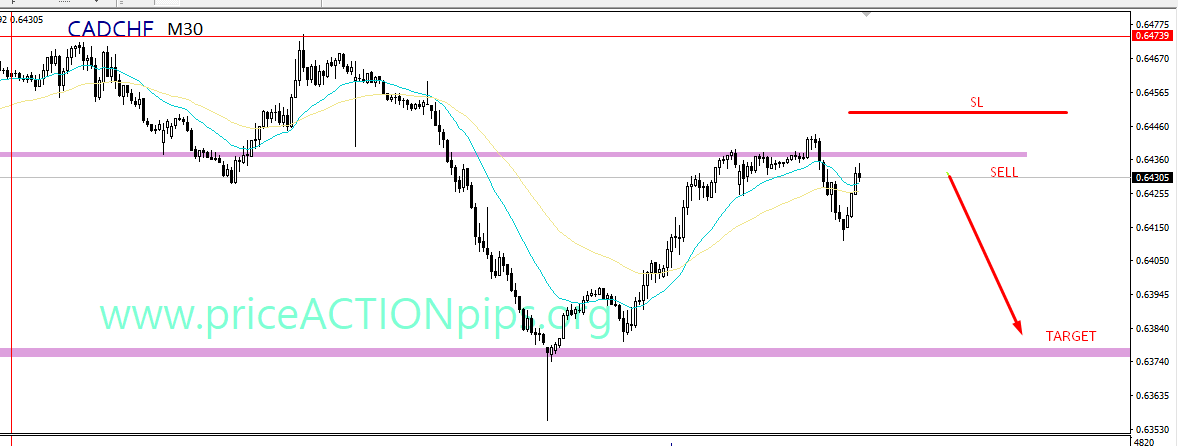

Trade Call: CADCHF Short Opportunity

Trade Type: Sell (Bearish)

Currency Pair: CADCHF

Initial Sell Entry:

- Sell at Current Market Price (CMP): 0.64300: Initiate a short position with a half-percent risk.

Additional Sell Entry:

- More Sell at 0.64400: Add to the short position with a sell order.

Profit Target:

- ✅ Take Profit 1 (TP1): Set at 0.63800, representing the level where profits may be secured.

Stop Loss:

- ❎ Stop Loss (SL): Place the stop loss at 0.64500, serving as a risk management measure to exit the entire trade if the price moves against the anticipated direction.

Risk Management:

- Utilize a half-percent risk for the initial entry, ensuring prudent risk management practices.

The rationale for the Trade: The decision to initiate a short position on CADCHF is grounded in a comprehensive analysis, considering technical indicators, potential resistance levels, and a bearish sentiment towards the Canadian Dollar against the Swiss Franc.

Market Conditions: Current market conditions suggest a potential weakening of the Canadian Dollar against the Swiss Franc. Monitoring economic indicators and global developments impacting CADCHF will be crucial for informed decision-making.

Adaptability: The strategy incorporates adaptability, allowing for adjustments based on evolving market conditions. Regular monitoring of the trade enables timely responses to any divergence from the initial analysis.

As always, trading involves risks, and it’s crucial to conduct your analysis and stay informed. Seek advice from financial professionals for personalized guidance based on your specific circumstances.

Join us for Free Forex Signals. We are the Best Forex Signals provider. Elevate your trading journey with expert insights at no cost. Our expert guidance ensures success.