TECHNICAL ANALYSIS

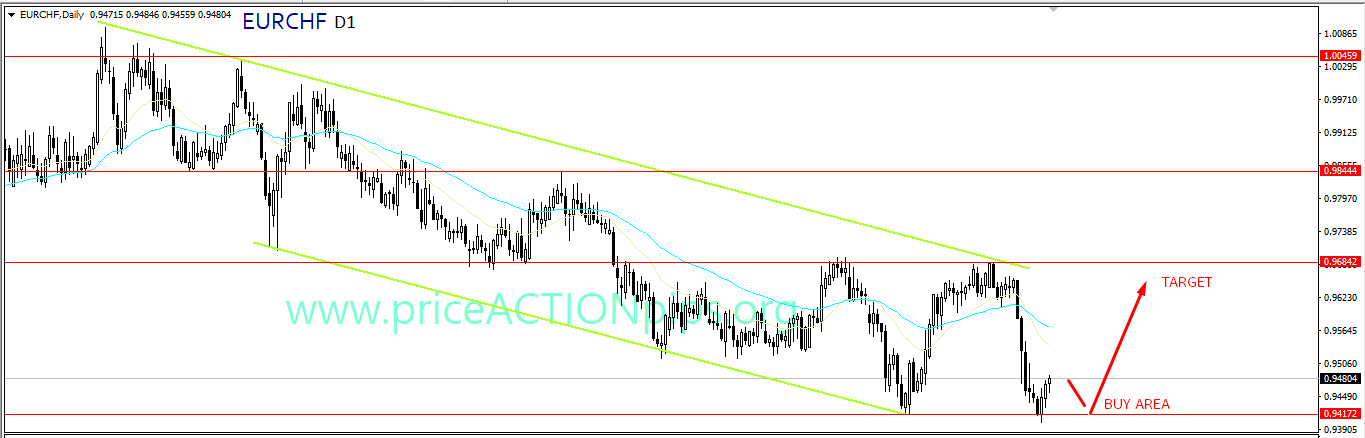

- Currency Pair: EURCHF

- Trade Type: Buy (Bullish)

- Buy Area: The identified buy area is at 0.94000, signaling a strategic entry point aligned with the anticipated bullish trend.

- Profit Targets:

- Target 1 (TP1): The initial profit target is set at 0.95000, indicating a level where profits may be secured.

- Target 2 (TP2): A secondary target is established at 0.96500, suggesting the potential for an extended bullish move.

- Stop Loss: To manage potential losses, a stop loss is placed at 0.93500, defining the level at which the trade should be exited to limit potential downside risk.

Additional Considerations

- Market Conditions: Assess the broader market conditions to ensure they align with your bullish outlook. Keep an eye on economic indicators, geopolitical events, and any developments that may impact the EURCHF pair.

- Technical Confirmation: Look for technical indicators or chart patterns that confirm the bullish signal. This could include trendline breaks, moving average crossovers, or other relevant technical signals.

- Fundamental Factors: Consider fundamental factors that may influence the Euro (EUR) and Swiss Franc (CHF). Keep abreast of economic data, central bank decisions, and geopolitical events that could impact the currency pair.

- Risk Management: Revisit your risk management strategy. Ensure that your position size is appropriate for your risk tolerance, and that the overall risk-reward ratio aligns with your trading plan.

- News Events: Stay informed about upcoming economic releases and news events that might affect EURCHF. Unexpected news can lead to volatility, and it’s essential to be prepared for potential market reactions.

- Monitoring and Adjusting: Continuously monitor the trade and be prepared to adjust your strategy if needed. If price action or new information suggests a change in market conditions, be flexible in adapting your approach.

Remember, the success of a trade involves a combination of accurate analysis, effective risk management, and adaptability to changing market dynamics. It’s advisable to stay informed, remain disciplined in your trading plan, and consider seeking advice from financial professionals if needed.